Our Points Update: 20 free nights this year!

It’s been a busy year for us! We’ve traveled most months, had a whole bunch of visitors (thanks for coming, guys!), moved to a new house, found out we’re having another baby annnndddddddd Owen started KINDERGARTEN. Whew. Oh yeah, in between there we were also working and keeping our children in one piece.

I’m going to have some fun looking back at our year this week (I hope), but I wanted to start by giving a bit of an update on our use of points (and perks and credits) to pay for some of our trips this year. It’s no secret that we are playing the “points game” to help defray the costs of all the trips we want to take (I’ve talked about this before (here and here), but this year we ended up going a little different route.

Basically, this year we didn’t go back to the U.S. (except for Chris for work) and we exclusively booked trips using low-budget carriers. EasyJet, RyanAir, Volotea — that was it for the year. Since you can’t use points for low-budget carriers like those, we didn’t have the need (opportunity?) to burn ours that way, unlike years past.

SO: We set out to defray the cost of our trips by reducing the other major expense of traveling: accommodations. Here’s how it shook out.

February: 4 nights at AppartBrussels (roughly 30,000 Chase points)

May: 3 nights in the Berlin Marriott Hotel (120,000 Marriott points)

June: 3 nights in Edinburgh AirBnB (used our $300 annual travel credit from Chase to cover the $100/night cost)

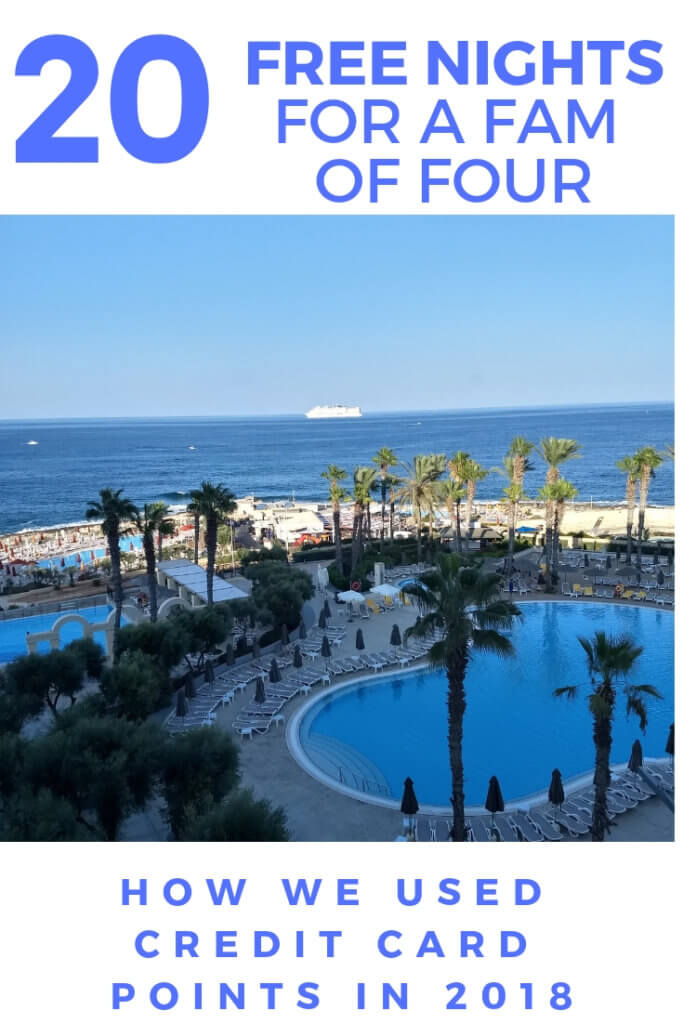

August/September: 5 nights at Hilton Malta (200,000 Hilton points and 5th night free)

October: 2 nights at Berlin Marriott Hotel (70,000 Marriott points)

November/December: 2 nights at Hampton by Hilton Frankfurt Messe (50,000 Hilton)

December: 1 free night at Aparthotel Adagio Access Petit France (Hotels.com free night after booking 10 nights on hotels.com in the past couple years)

By far the best was our stay at the Hilton Malta, our first resort experience! It was also the only time we very specifically churned points to go to a specific hotel property. To get to the 200,000 Hilton points we needed, I signed up for an American Express Hilton Surpass card (now called a Hilton Ascend) and a regular AmEx Hilton Honors card. Those two combined, plus the points generated as a minimum spend, easily got us to 200,000.

If you are interested in the Hilton Ascend card, it is a good time to get it (better than when I did, haha). Right now there is a sign up bonus of 150,000 points after you spend $3,000 in the first three months, which isn’t bad for a $95 fee. Plus, it comes with Gold status, which had some fun perks we enjoyed. If you are considering signing up for this one, please consider using my referral link here.

We ended up getting Chris the AmEx Hilton Honors card as well, a no-brainer since there is no annual fee on it. That, plus some points generated by our actual stays and Chris’ work stays, paid for our nights in Frankfurt plus another 60,000 stashed away for some time in the future.

If fee cards aren’t your bag, the no-fee Hilton Honors card is a great option! 100,000 points for $1,000 spend in three months. This one doesn’t come with gold status though. Here’s our referral link.

I’ve mentioned plenty of times before that we tend to prefer apartment rentals for a lot of reasons, one of which is that we don’t like sharing a room with our kids. Um, still true. In some of our points-stay situations we did still get our separate sleeping space: the Brussels and Strasbourg places were one-bedroom apartments with a sofa bed, and the Edinburgh place was a 2-bedroom AirBnB. Speaking of AirBnB, I just looked at we stayed in NINE different ones this year. Whew.

Of course, clearly hotels did happen this year– sometimes because we wanted to go to a specific property, some for convenience, some for points — and it honestly went way better than I expected! The older the kids get, the easier (at least marginally) hotels are because they can stay up a bit later, making it less frustrating for Chris and I to be sitting in a dark hotel room at 7:30 p.m. It was also a nice reminder of why hotels are awesome a lot of the time … fresh towels and a made bed every morning? WHAT LUXURY! We were also very partial to free breakfasts (gold status perk with Hilton!).

That said, I doubt we’ll be doing many hotel stays next year when we have an infant with us!

For our Marriott stays in Berlin, we had some leftover points from the past but we also had signed up for American Express Starwood cards in the past, which got us something like 25,000 SPG points each. Since Starwood and Marriott have merged, we transferred those to Marriott at a 3-to-1 ratio. It worked out great for us, but we’ve since cancelled those particular cards since it wasn’t worth it to us to hang on to the annual fee. If we happen to want to stock up on more Marriott points in the future, we’ll probably branch out to the Chase brand ones.

Which brings us to our last, and my favorite, credit card program. Chase! I know I’ve talked about this extensively before, but we really like how flexible this program is. Points can be transferred between spouses or to a lot of partner rewards program, but so far we’ve exclusively used to the Chase portal to book flights, hotels and rental cars where needed. (It basically works like a Travelocity website, you search for your destinations and it shows you options on a variety of carriers. Except then you can pay in cash, points or a combination of the two).

In the past, we’ve used our Chase points for a lot of things: covering the cost of 1.75 trips back to the States, flights to Paris last year, a hotel in Munich for Oktoberfest and a rental car for Slovenia. I’m not sure that the “experts” would say using the points for hotels in the portal is the best value, but basically it comes down to this for me: do I want to pay cash for this particular event? In February, it was worth it to me not to have to spend about $500 for accommodations for our low-cost Belgium trip ($40 flights!). It was also helpful to be able to use points for “apart-hotels,” which is rarely the case with mainstream points programs.

Chris has the Chase Sapphire Preferred card, which earns him 2 points per dollar on all travel spending and comes with an annual fee of $95, waived the first year. I have the Chase Sapphire Reserve card, which earns 3 points per dollar on travel and dining, plus a whole host of other perks. For us, the most important of these is primary rental car insurance and travel insurance. It comes with a whopping $450 annual fee per year, which hurts my heart every time, but that is pretty much outweighed by the $300 annual travel credit that resets each year. As I mentioned, we used ours this year to cover the three nights we spent in an AirBnB in Edinburgh. That was a long trip and the UK isn’t exactly known for being cheap, so it was nice to save some money where we could.

For this next year, we’re shifting our focus away from specific hotel points programs because with the new baby, that will be less of a practical option since one sleepless baby = five cranky travelers. Instead, I’m giving Capital One Venture Card a try, as you can use your points to “erase” travel-related purchases. Since the card had a 50,000 sign-up bonus ($500) and earns 2 points per dollar on every purchase, with the $95 fee waived the first year, we figured it was worth a try. I look forward to using it to cover some AirBnBs or EasyJet flights next year, once we get the newbie a passport!

Speaking of AirBnB, if you haven’t given it a try I’d highly suggest it! It can be a mixed bag — read reviews carefully! — but we really like having the added space so it shouldn’t be a surprise that we stayed in nine different ones this year. You can save $40 off your first booking (plus getting my gratitude) by using my referral link!

So, I think that about does it for now. Next up: a look at our flights from this year! Because I am a nerd.